A few weeks back I spotted THIS article that Rex Woodbury put out on ‘influencer IPOs’ and investing in influencers. It follows on from my interview with Mark Dandy back in 2020 on the future of influencers - where are we going with it?

Rex is a great thinker and has written other superb articles on:

Highly recommend checking out his letter - Digital Native.

Today I wanted to pick his brains a bit on the influencer IPO article he wrote. Its something I’ve articulated before. E.g. What if, back in the day, you had been bullish on Kylie Jenner or Jeffree Star creating their own brand, how could you invest early and enjoy a slice of the eventual return? VC and private equity has been slow off the mark to come up with solutions for this in the face of some of this massive wave of success in the 2010s and influencers becoming a new celebrity class. e.g.

Kylie Cosmetics (Coty acquired 51% of the business for $600m back in November 2019)

Babe Wine - Fat Jewish (acquired by ABinBev)

Jeffree Star Cosmetics (1 million total eyeshadow palettes sold — including the flagship Conspiracy Palette as well as a smaller Mini-Controversy Palette — in roughly 30 minutes)

Mr Beast - Opened 300 delivery-only burger joints

What are the technologies that are going to allow that to happen as power keeps shifting from institutions to individuals in the 2020s?

So let’s get into it.

For readers who don’t know, can you describe how Ruhnn’s business model works? Is the West replicating this?

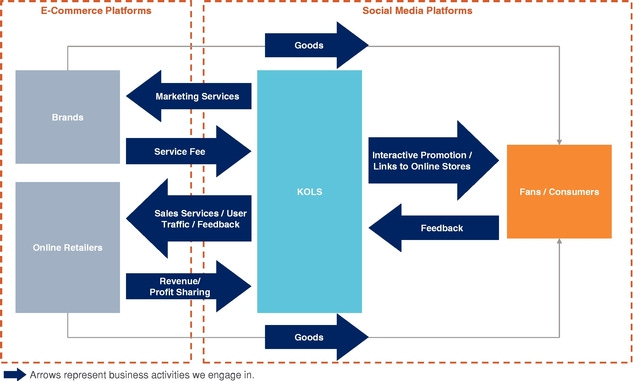

Sure. Ruhnn is a Chinese company that incubates, grows, and monetises influencers (known in China as Key Opinion Leaders, or KOLs). Ruhnn identifies promising social media creators, helps those creators grow their followings, and then helps them monetise through commerce (typically Taobao stores). In 2018, Ruhnn had 113 influencers generating $300 million in sales. (A more detailed overview of Ruhnn’s business model can be found here.)

There’s no direct parallel to Ruhnn in the U.S., but there are companies helping creators grow and monetise their followings.

TikTok’s Creator Fund supports creators, starting with $200 million and growing to $1 billion within three years.

ROB: On TikTok, Creator Fund payouts are driven by engagement and views; in contrast, YouTube — which pays creators 55% of ad revenue shown on their videos — incentivises creators to make content for an affluent, advertiser-friendly audience.

The higher the advertising rates and more sought-after the audience is for advertisers, the more creators earn on their videos. Likewise, on Instagram, the prevailing monetisation model of affiliate links and brand sponsorships incentivises creators to cater towards a high-income audience.

So some have argued TikTok is broadening the ability to become successful as a creator - I discuss this a bit later.

REX:

Jemi helps creators earn money by interacting with fans, while Pietra helps creators launch their own product lines.

Substack is offering advances to writers joining its platform

Podfund, in the podcasting vertical, provides funding between $25,000-$150,000 to podcast studios and high-potential creators in exchange for a revenue share.

Patreon, launched Patreon Capital in February 2020 to finance creators. Patreon Capital at the moment is not taking equity stakes, they are offering cash loans.

“Patreon provided the team with a cash advance of around $75,000 (to Multitude, a Brooklyn-based podcast collective and production studio) to cover the production budget for the series, with the expectation for Multitude to pay back a slightly greater sum from Next Stop’s Patreon earnings over the next two years.”

Pocket.watch (raised $21m in series B funding) incubates kid influencers - ‘the modern version of the Disney Channel’. They also partner with kid creators to take their channel to the next level. 👇

Is the biggest roadblock to an ‘influencer IPO’ or success-sharing, the incumbents (e.g. record labels in the music industry) or technological issues and a lack of thought up until now on what the solution could be?

There are dual roadblocks here:

An aversion to change (especially among the media gatekeepers from a pre-internet era), and the lack of a winning solution. The power structures in the movie, television, and music industries haven’t changed much in the last 25 years. In each industry, a handful of executives are the decision-makers, allocating fame and influence to celebrities. The internet is breaking down these barriers, but talent selection and financing still mostly comes top-down rather than bottom-up.

There also hasn’t been an innovative solution for creators and their fans. This is partly because the creator economy is in its infancy, and partly because of the many challenges behind a new model.

ROB: There has been a lot of focus on tools for the creator/influencer (Patreon, Substack, OnlyFans etc.) vs. tools for fans and early evangelists to capture economic returns

REX: We’re still in the early innings of the creator economy. Building a career as an online creator is a relatively new profession, and early tools and platforms are built to enable the emerging entrepreneurs in this new economy.

Once creators are established and able to earn a living, we’ll see clever models emerge to better retool economic models and power structures. Many creator-focused platforms, including those you mention, will also build in features that let fans finance their favourite creators and share in the upside.

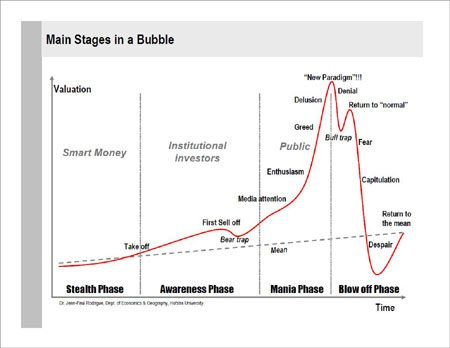

ROB: I think some of this will look a bit like a mini bubble curve.

A theoretical scenario could be:

A few early players and MVPs aware of the problem start working on technology for it (tokens, coins, other contract types). This grabs the attention of other investors and influential people.

‘Dobrik Capital’ (a made up investment firm) makes news with an investment in a promising early stage gamer on Twitch ($50,000 @ 10% of future returns)

Public attention arrives to influencer investing thanks to this and other big deals involving spotting talent. e.g. ‘Hey Sisters Fund’ invests in 5 new YouTube beauty creators @ 10% too. One of the creators goes on to found a Huda Beauty style company and the fund makes enormous returns from it.

There is a mini-bubble of influencer investing mania, crowdfunding or similar areas open up more and more to the public who see it as a get-rich-quick scheme after late news of high ROI for a few early investors in new gaming and beauty stars.

Disillusionment sets in as ethical issues become apparent (content distorted by what investors want), fraud takes shape in unregulated space (inflation of creator’s value on IPO), and the hype begins to fade.

As a trough is hit, certain technologies mature to reduce the fraud and deliver the initial promises, taking the interest back to a gradually increasing curve.

What would be some of the primary similarities and differences of investing in an influencer vs. a company/stock?

REX: Investing in one person poses incredible “key person risk”.

If you think Amazon is too reliant on Jeff Bezos or Tesla is too reliant on Elon Musk, imagine the risk of investing directly in Bezos or Musk.

There are also ethical issues to be worked out: it’s one thing for shareholders to have influence over a company, but it’s another for “shareholders” to have influence over a fellow human being.

There will need to be safeguards in place that protect the creator. If done right, the creator will have more agency in this model than in a previous “gatekeeper” era, while fans will also enjoy more influence and economic upside.

You ran through some math in your post for what the ROI or time horizon could have been for investing in Taylor Swift or BTS. For readers to understand a bit clearer, how would this kind of investment compare to other asset classes?

It will vary quite a bit between creators.

Record labels don’t recoup the advances given to the majority of artists.

Venture capitalists don’t earn a return on most startups (power laws)

Creators will follow a similar pattern: many will be supported by early superfans, but never achieve breakout success.

Others, though, may be the next Taylor Swift or BTS. In a number of years, fans may earn a 10x or 100x return. Creators would likely be a risky asset class.

ROB: The nature of power laws for influencers suggests the risk/return would be equivalent to venture capital, if not more severe due to ‘key person risk’ and the similarity to entertainment businesses.

ROB: I frequently link subscribers to THIS awesome article by Michael Tauberg which definitively lays out the structure of ‘power laws’/winner take all and the returns in the media and entertainment businesses (also common throughout nature and complex systems - e.g. city populations).

Wired magazine’s Chris Anderson argued back in 2004 about the internet opening up the ‘long tail’. Whilst this has played out in some verticals (e.g. search engines) power laws are often inescapable for influencers - tech advancements have exacerbated them too (ease of distribution). Li Jin, writes an interesting article in the Harvard Business Review, discussing some of this ‘need’ for a ‘middle class’ in the creator economy and how it could happen. Tellingly she writes:

On Spotify, for instance, the top 43,000 artists — roughly 1.4% of those on the platform — pull in 90% of royalties and make, on average, $22,395 per artist per quarter. The rest of its 3 million creators, or 98.6% of its artists, made just $36 per artist per quarter... In 2018, the top game on Roblox accounted for 8 to 10% of concurrent users, while in 2020, the top game accounts for upwards of 20 to 25% of concurrent users.

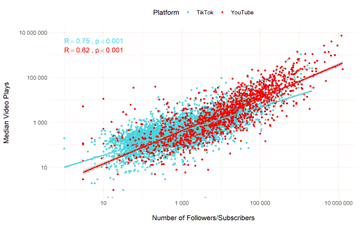

I’d be personally bearish on the kind of ‘creator middle class’ scenario that Li Jin is suggesting needs to happen - 99% of the time I’d bet on the power law dynamic. Becoming an influencer is not equivalent to getting an education and going into a profession for example, there can’t be millions of ‘creators’ because people’s attention span is finite AND the most talented capture disproportionate amounts of attention. So naturally, views and rewards would be expected to stay with the top x% most talented like in music, gaming, books, movies, news.

Platforms like TikTok already have low barriers to entry (a smartphone and some talent). The Lorenz curve & Gini co-efficients (measures of inequality) on TikTok views are very steep.

To put that into perspective, here are the Gini coefficients of some other things:

Income in the United States: 0.41

Income in South Africa (the world’s most unequal country): 0.63

Likes on Tinder: 0.58

Followers on Instagram: 0.82

So on TikTok, obviously due to FYP, the followers are less important but the views still tend to form a power law distribution.

What are some of the most interesting companies or people you’ve seen building solutions or MVPs for the space?

REX:

Scout is building digital trading cards. With Scout, creators can identify their superfans and those superfans can unlock new levels of access to their favourite creators.

Cent - Fans can “Seed” creators who they think will create more value in the future. Seeding is giving a set amount of money to a creator each month, and receiving a portion of all Seeds given after you. This gives the creator a monthly income and incentivises early fans to share the creator’s work. - You can “Spot” any post on the network. This is simply a fun way to give 1 cent to the creator of a post to show you appreciate their work, and you can hit the Spot button as many times as you want. 1,000 Likes is 1,000 Likes. 1,000 Spots is $10.

Rally - another creative solution using blockchain. ‘Fans can buy, donate, and hold their favourite creator’s creator coin. Through blockchain technology, creators will be able to verifiably identify their biggest fans and provide personalised rewards."

Imagine discovering Ninja playing Fortnite Battle Royale in October 2017 before it reached the mainstream the following year. Or stumbling upon trick shot aficionados Dude Perfect’s inaugural YouTube video in 2009 before they became household names. Instead of simply following them, you could support them via Creator Coin and be an active member of their communities. As Ninja fought his way to the top of the gaming world and amassed nearly 15 million followers on Twitch, if you were earning and holding his Creator Coin, you could potentially see them accrue value. Similarly, as Dude Perfect amassed 52 million subscribers on YouTube, any digital collectibles you earned or purchased, such as a rare, digitally signed autograph or a one-of-a-kind doodle, could also potentially accrue value. -Kevin Chou, founder of Rally

Bigger companies are also moving in this direction (Patreon and TikTok’s funds are two examples).

We’ll see more social platforms and content platforms also give creators and fans better tools to capture their own economic value creation.

Following from above…If you had a bullet point New Year wish-list for pieces of tech you’d like to see for the market what would they be? What are the first problems that need addressing?

I would love to see a “Robinhood for creators”. Is there an easy way—in a beautiful interface—for me to financially support or invest in the people that I believe in? If I discover a great newsletter, can I “buy stock” in that writer? If I have a new favourite TikTok comedian, can I invest in her?

Eventually, we might be able to purchase a share of future earnings in exchange for early financial support and evangelism. But a stepping stone could be unlocking new levels of access. If I support an early artist I found in my Discover Weekly on Spotify, can I get backstage passes and great seats to the artist’s next show?

I want it to be easier—and fun—for me to support the people that I admire and believe in. And I think that as a superfan, I should earn rewards—whether monetary or non-monetary—in return for my fandom.

This post is incredible! Thanks Rob!